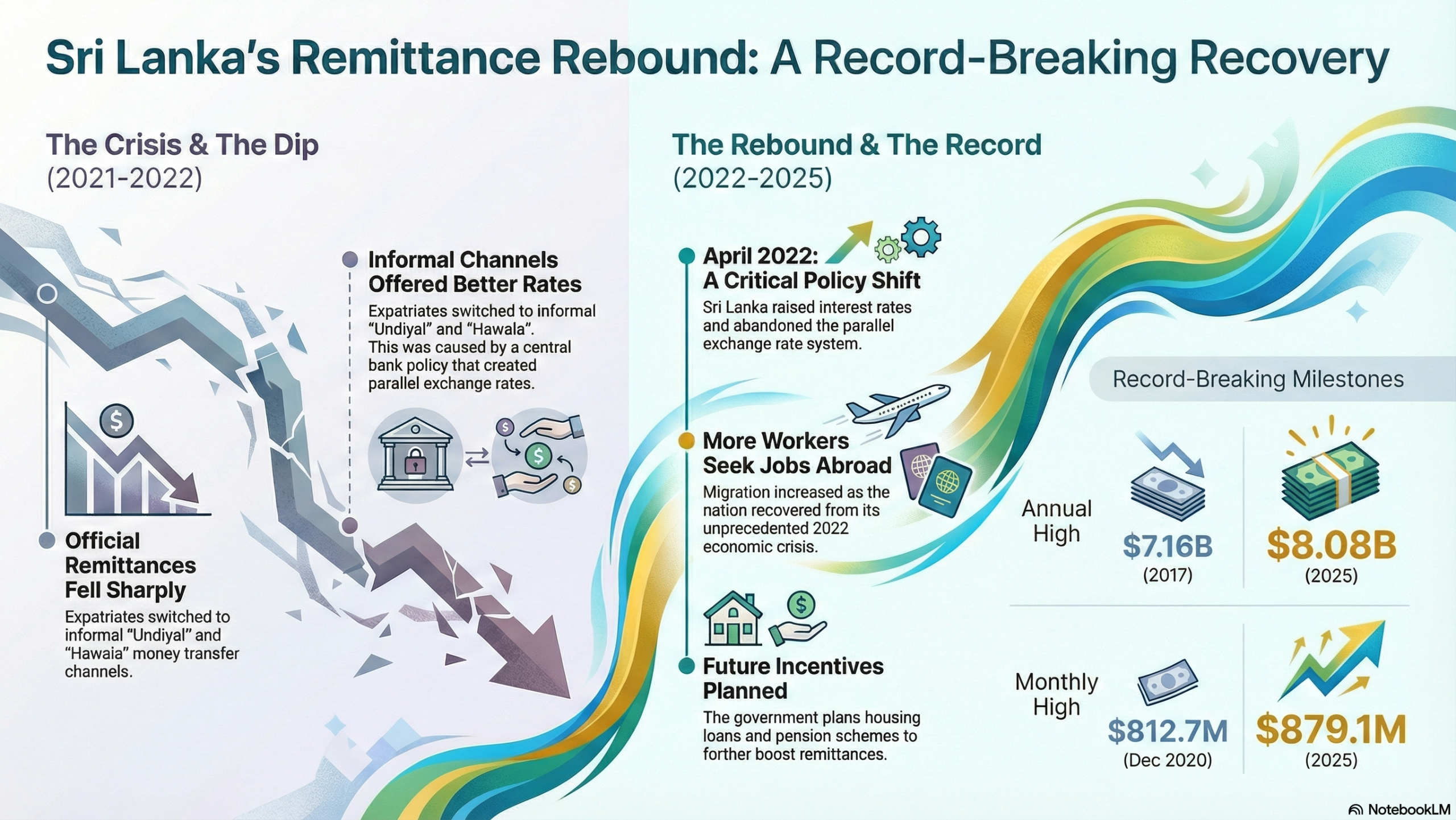

According to data from the central bank, Sri Lanka’s official remittances surged by 43.2% to reach a record monthly high of US$879.1 million in December 2025. This contributed to an annual total of US$8,076.2 million, marking an all-time peak compared to the previous year.

The remittances in December 2025 exceeded the previous monthly record of US$812.7 million set in December 2020. The last annual record high for remittances was US$7,164 million in 2017. This increase in worker remittances follows a significant number of Sri Lankan workers seeking employment abroad as the country recovers from the severe economic crisis of 2022.

In 2025, total remittances rose by 22.8% from the previous year’s figure of US$6.58 billion. Worker remittances remain the highest source of foreign exchange revenue for Sri Lanka, which is still navigating the aftermath of its 2022 economic downturn.

In its 2026 budget, the Sri Lankan government has committed to introducing housing loans and a contributory pension scheme for citizens employed overseas as an incentive to boost remittances. The consistent rise in remittances follows the central bank’s decision to abandon a parallel exchange rate system, which had previously driven many expatriates to use informal money transfer methods such as Undiyal and Hawala.

The country is also focusing on sending more skilled workers abroad to increase foreign exchange inflows since declaring bankruptcy in 2022. There was a significant drop in official remittances in 2021 as many expatriates opted for informal channels offering higher exchange rates than formal banking systems.

This shift occurred after the Central Bank intervened in the foreign exchange market by printing money to maintain low policy rates, inadvertently creating parallel exchange rates managed outside the formal banking network. Starting in April 2022, interest rates were significantly increased to curb credit growth and reduce the need for money printing. Subsequently, the Central Bank adopted a dovish monetary policy approach.

(Colombo/January 10/2026)