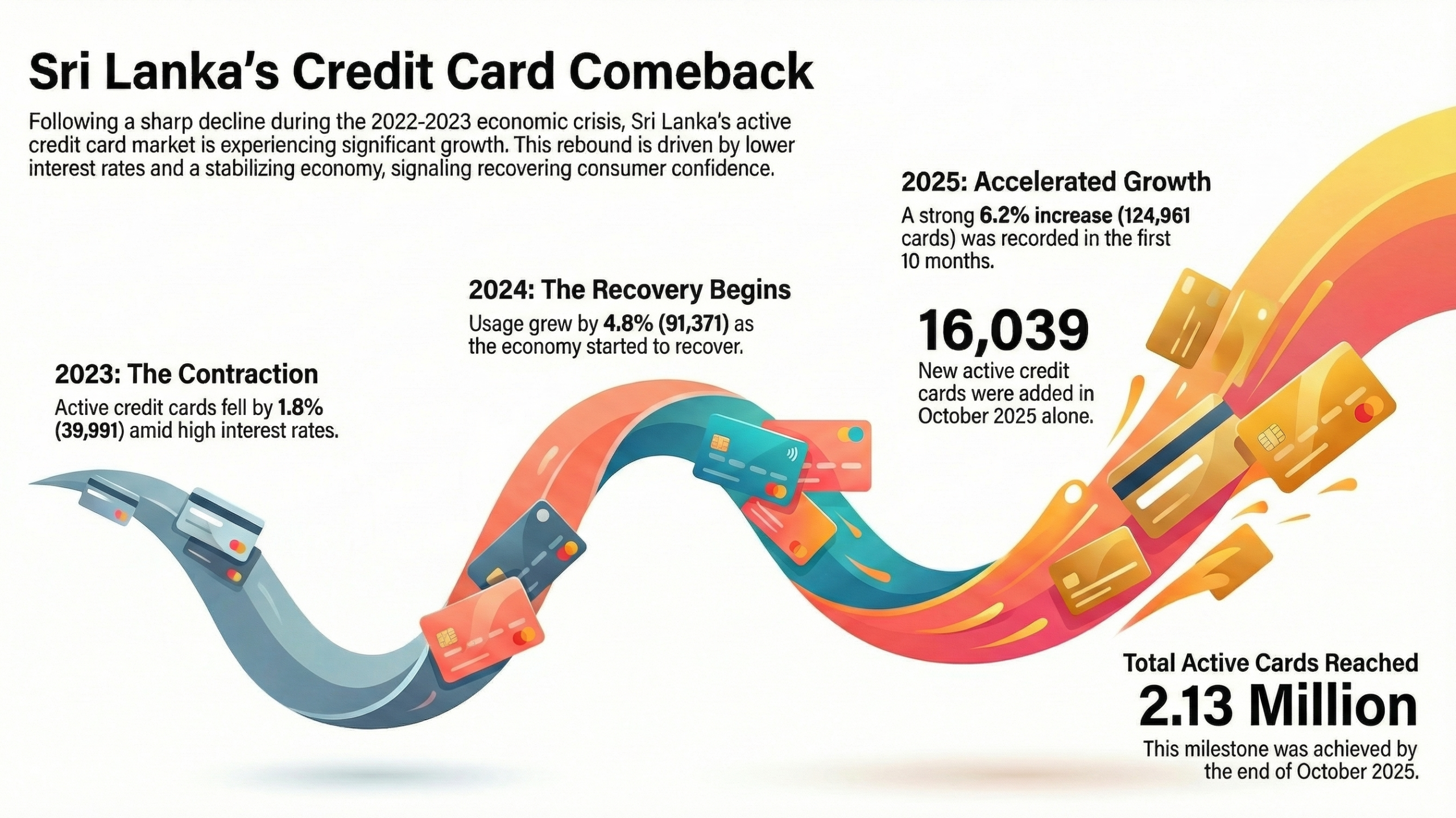

In October, Sri Lanka saw an increase of 16,039 in new active credit cards, according to data from the central bank. This rise comes amidst the country’s economic recovery and the trend of lower interest rates.

By the end of October, the total number of active credit cards stood at 2,133,417, up from 2,117,378 at the end of September, marking a 0.76 percent increase over the month. Over the first ten months of the year, active credit cards increased by 6.2 percent, or 124,961 cards.

In 2024, active credit cards in Sri Lanka grew by 4.8 percent, or 91,371, as the nation experienced economic recovery alongside robust credit card promotions driven by declining interest rates.

Analysts have observed that many banks have partnered with supermarkets and other vendors to promote credit cards in the current low-interest-rate environment, coinciding with a stronger-than-expected economic recovery in the country. This economic stability has encouraged customers to utilize credit cards more frequently than in 2023.

Some analysts noted that previously higher penalty interest rates had led some users to cancel their cards last year. However, these customers appear to be actively using their cards again now.

In contrast, active credit cards decreased by 1.8 percent, or 39,991, in 2023, following the country’s declaration of bankruptcy in 2022. This decline was triggered by a significant hike in the Central Bank’s monetary policy rates. The sharp increase in interest rates in April 2022 was a measure to combat hyperinflation. Inflation eventually slowed to deflation in September last year before turning positive in August this year, following the central bank’s reduction of key policy rates on eight occasions since June 2023.

(Colombo/December 29/2025)