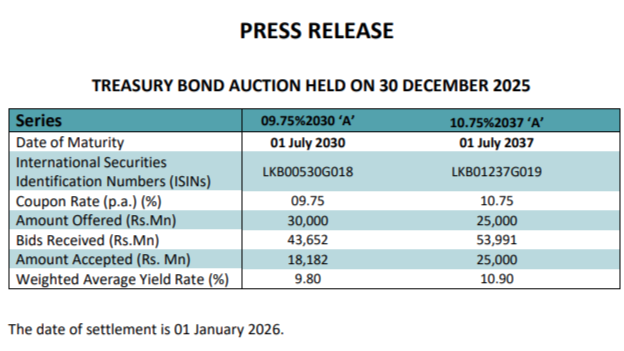

FINANCIAL CHRONICLE – Sri Lanka successfully raised 43.18 billion rupees through the sale of bonds maturing in 2030 and 2037, according to data from the public debt management office. The initial offering was set at 50 billion rupees.

The issuance included 18.18 billion rupees worth of bonds maturing on July 1, 2030 (LKB00530G018), out of an offered 30 billion rupees. These bonds were sold at an average yield of 9.80 percent.

Additionally, the entire 25 billion rupees of bonds maturing on July 1, 2037 (LKB01237G019) were sold, achieving an average yield of 10.90 percent.

The 2030 bond remains available on tap. (Colombo/Dec30/2025)