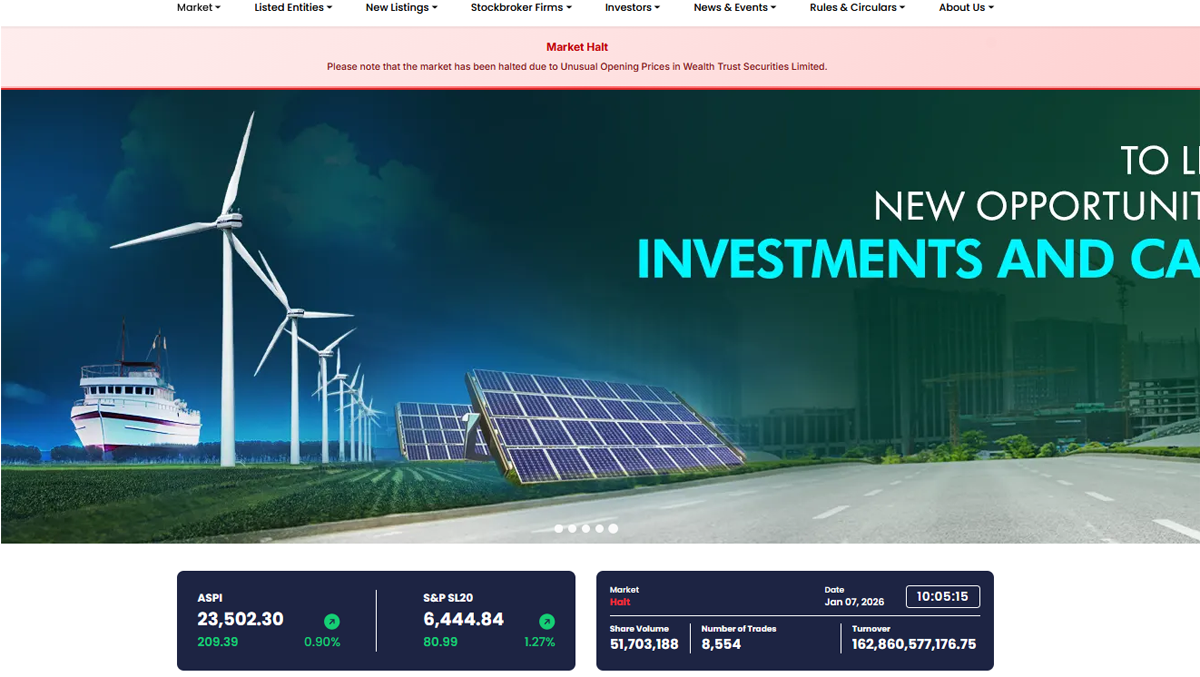

The Colombo Stock Exchange (CSE) in Sri Lanka was closed for the day, with all transactions canceled following an erroneous trade involving shares of Wealth Trust Securities, which made its debut on Wednesday.

In a statement, the CSE explained, “Based on the request made by industry participants and to ensure a fair and orderly market, the CSE, in consultation with the Securities and Exchange Commission (SEC), has decided to close the market for the day.”

The statement further noted, “As notified earlier, CSE has canceled all orders and transactions carried out today prior to the market halt. Trading will resume tomorrow as usual.”

Trading was initially halted after an order to purchase Wealth Trust shares at a price of 25,000 Sri Lankan rupees was executed. Wealth Trust had offered its shares at a price of 7 rupees during its initial public offering (IPO).

This transaction caused the market turnover to skyrocket to 162 billion rupees just a few minutes after the market opened. Typically, the CSE system prevents setting extreme purchase prices for previously traded shares, but such restrictions do not apply to IPO shares, according to an official.

Details remain unclear regarding how a purchase order totaling 150 billion rupees was processed, as confirmation of buying power is generally required.

Wealth Trust Securities clarified that the trades were conducted by third parties. The company stated, “The Company further confirms that no shares have been sold by pre-IPO shareholders in the market.” They added, “There is no impact on the Company’s fundamentals, operations, or previously disclosed information.”

The firm urged regulatory authorities to investigate the matter and take necessary actions to prevent similar market disruptions in the future.

(Colombo/Jan08/2025)