On Thursday, the Colombo Stock Exchange in Sri Lanka concluded trading with minimal movement, as companies reported mixed earnings, according to brokers.

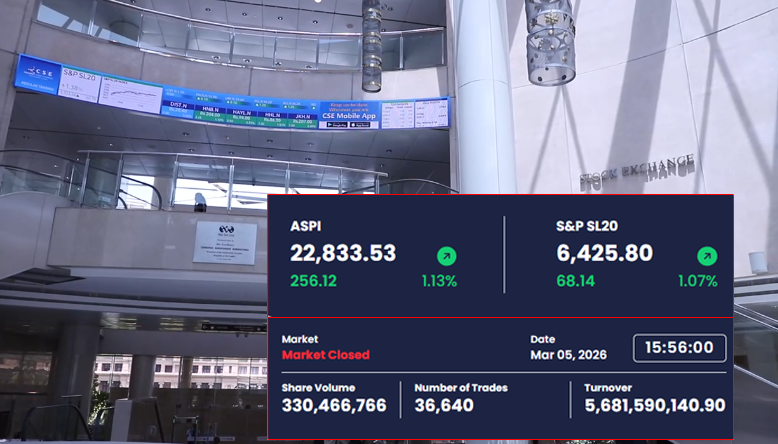

The All Share Price Index experienced a slight decline of 0.01 percent, or 3.17 points, closing at 23,652.51. The S&P SL20 decreased by 0.18 percent, losing 12 points to settle at 6,599.52.

“The market remains nearly unchanged, maintaining the sideways trend observed over the past few days,” stated Ranjan Ranatunga, Assistant Vice President – Research at First Capital. “There was noticeable interest in penny stocks from retail investors, while interest in larger companies was subdued.”

The top positive contributors to the All Share Price Index (ASPI) included Ceylinco Holdings at Rs.3,300.00, Colombo Dockyard at Rs.153.50, and National Development Bank at Rs.148.75. Conversely, Richard Pieris and Company, priced at Rs.36.80, made the most significant negative impact on the ASPI.

The market turnover reached 4.84 billion rupees, with banking stocks accounting for the largest portion of the turnover at 1.43 billion rupees. “Turnover was significantly below the monthly average,” Ranatunga added.

In corporate announcements, Mercantile Investments and Finance revealed a rights issue involving 33,400,000 new ordinary voting shares, each priced at 33 rupees. The company’s shares closed down by 1.45 percent at 34.00 rupees.

Furthermore, DFCC Bank disclosed plans to raise up to 10 billion rupees through its green, social, and sustainability-linked (GSS+) debenture issue, with its shares closing up 0.32 percent at 158.00 rupees.

Additionally, United Motors Lanka announced a second interim dividend of 0.25 rupees per share, though its stock closed down 2.27 percent at 38.70 rupees.

(Colombo/Feb12/2026)