FINANCIAL CHRONICLE – The Public Debt Management Office of Sri Lanka has successfully sold treasury bills worth 10,000 million rupees on tap at average yields of 7.88 percent and 8.47 percent. With this transaction, the total amount of treasury bills sold this week has reached 110 billion rupees.

Specifically, the debt office sold 3-month treasury bills at an average rate of 7.88 percent, while 12-month bills were sold at an average yield of 8.47 percent.

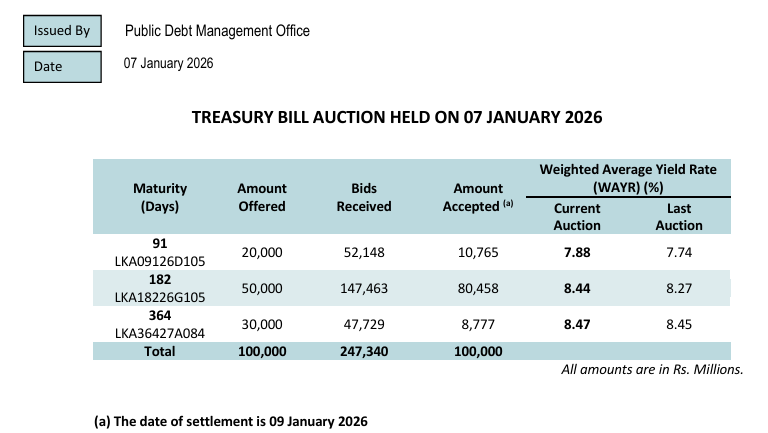

Earlier, on Wednesday (7), the debt office raised 100 billion rupees through the sale of 3-month, 6-month, and 12-month treasury bills.

The settlement date for these transactions is set for January 9. (Colombo/Jan9/2026)