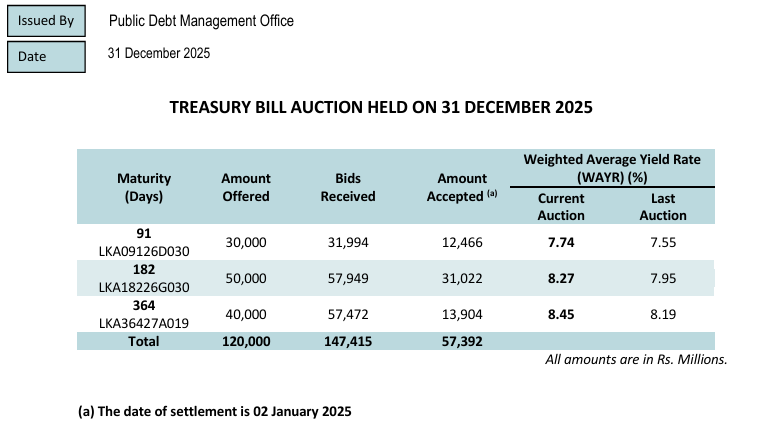

FINANCIAL CHRONICLE – Data from Sri Lanka’s Public Debt Management Office indicates an increase in Treasury bill yields across various maturities at the auction held on Wednesday. Notably, the 6-month yield experienced a rise of 32 basis points, reaching 8.27 percent.

The weighted average yield for the 3-month bills increased by 19 basis points, resulting in a yield of 7.74 percent. Out of 30 billion rupees offered, 12.46 billion rupees were sold. Similarly, the 6-month bills saw a rise of 32 basis points in the weighted average, settling at 8.27 percent, with 31.02 billion rupees sold out of the 50 billion rupees offered.

The 12-month yield also rose, increasing by 26 basis points to reach 8.45 percent.

Over recent months, Sri Lanka’s short-term bill yields have occasionally fallen below the overnight interbank rate and remained unusually flat, despite significant growth in private credit. This phenomenon, referred to by balance of payments crisis observers as the ‘ramrod rate anomaly,’ has drawn attention.

Higher rates can potentially attract more cash into the bill markets, prompt rapid adjustments in the credit system to align with government cash flows, and crowd out private credit, thereby reducing the risk of currency crises or defaults.

There have been concerns that the rate cut in May might hinder efforts to collect reserves and repay debt by mis-signaling rates. However, there have been no inflationary open market operations similar to those seen in 2025, and a prudent scarce reserve regime is being maintained.

(Colombo/Dec31/2025)