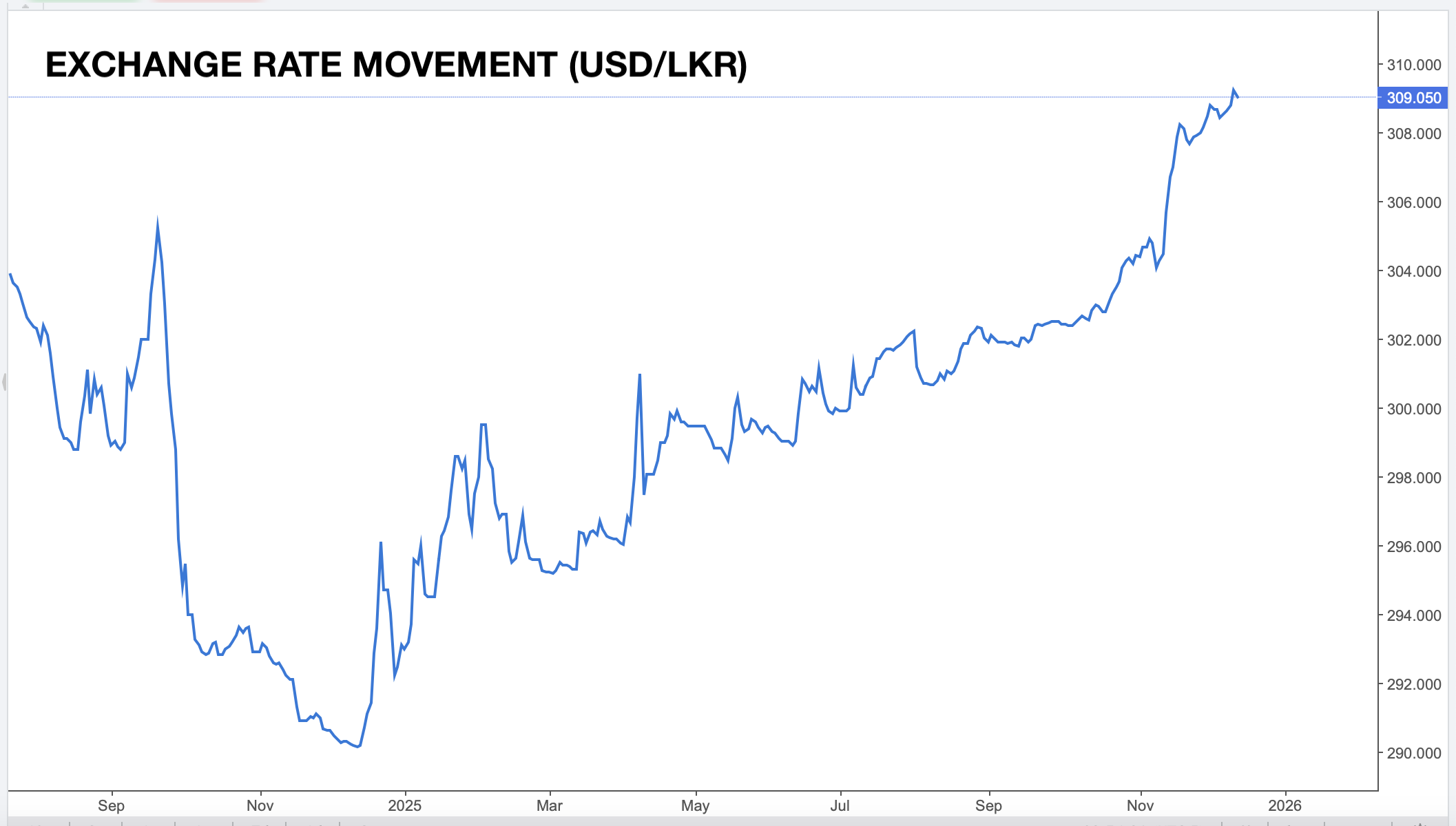

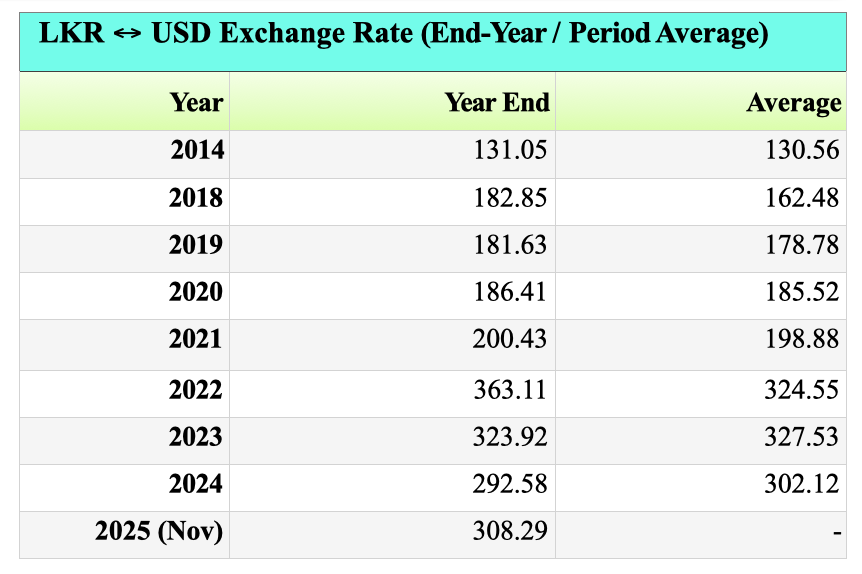

The Sri Lankan Rupee (LKR) is beginning to show signs of renewed depreciation after months of relative stability, with economic analysts projecting a potential weakening toward the Rs.320–340 per USD range in 2026, even with intervention by the Central Bank of Sri Lanka (CBSL). The projection comes amid widening outflows observed in the final quarter of 2025 and structural pressures in the external sector.

According to Central Bank of Sri Lanka (CBSL) exchange data, the rupee has weakened year-to-date by over 5% against the dollar as of early December, reflecting rising external pressures on the economy and foreign exchange market. Central Bank of Sri Lanka

The CBSL’s latest Monetary Policy Review for late 2025 reaffirmed its commitment to a flexible inflation-targeting framework under a flexible exchange-rate regime a policy environment designed to allow market forces to determine currency value while controlling inflation. The Monetary Policy Board has chosen to keep the Overnight Policy Rate (OPR) unchanged at 7.75% across multiple meetings this year, underscoring a cautious approach aimed at balancing inflation and growth. Central Bank of Sri Lanka

In its Market Operations Report for mid-2025, the CBSL reported marginal depreciation of the rupee against the dollar under the flexible exchange rate regime and highlighted its interventions in foreign exchange markets to reduce volatility.

External Headwinds and Policy Challenges

The rupee’s performance comes against a backdrop of broader economic difficulties across the South Asian nation. A recent natural disaster, Cyclone Ditwah, inflicted widespread damage, prompting the central bank to call on commercial lenders to offer temporary debt relief for affected borrowers a move aimed at cushioning economic fallout. Reuters

Foreign exchange reserves have shown limited improvement, fluctuating around USD 6.2 billion in late 2025, data suggests, underlining the challenges of sustaining external buffers. Trading Economics

Despite these pressures, the CBSL has maintained that its monetary stance remains appropriately calibrated to steer headline inflation toward its 5% target by mid-2026 a primary objective under its flexible inflation-targeting policy. Central Bank of Sri Lanka

Outlook for 2026

Market watchers note that the sustainability of the rupee will depend heavily on foreign exchange inflows through exports, tourism, and worker remittances all critical drivers of external balance and reserve stability. Additionally, investor confidence, foreign direct investment, and broader macroeconomic policy coherence will play key roles in shaping currency dynamics. Analysts caution that temporary pressures related in part to reconstruction spending and capital flows could persist into next year, affecting the balance of risks. Central Bank of Sri Lanka

As the new year approaches, the CBSL likely to monitor macroeconomic developments and foreign exchange conditions closely, with periodic monetary policy reviews expected to guide future interventions and strategy.