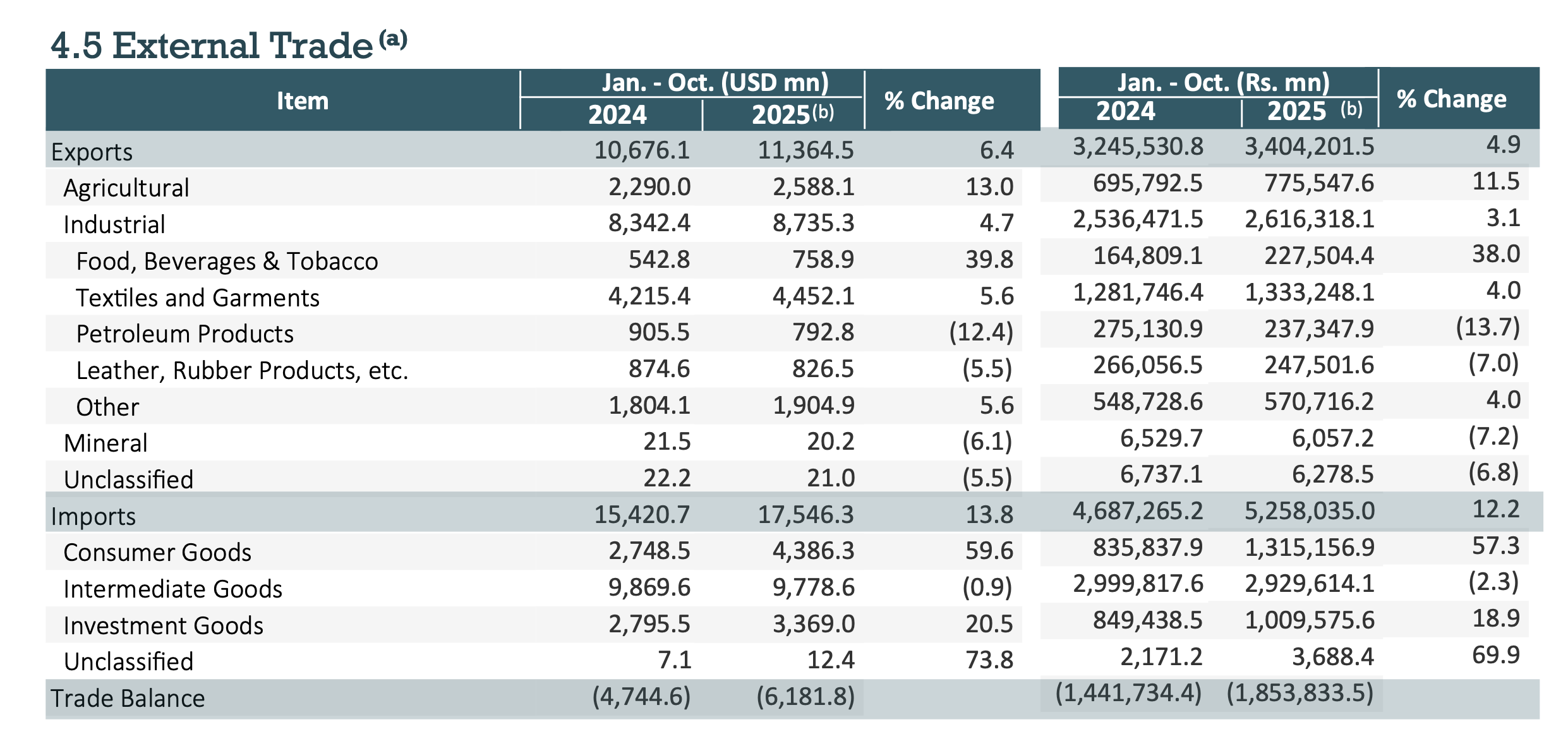

Sri Lanka recorded a notable expansion in external trade during the first ten months of 2025, with both exports and imports increasing, according to provisional data. While stronger export earnings helped support foreign exchange inflows, the sharper rise in imports widened the overall trade deficit.

Exports rose 6.4% to USD 11.36 billion between January and October 2025, compared with USD 10.68 billion in the same period of 2024. In rupee terms, export earnings grew 4.9% to Rs. 3.40 trillion. Agricultural exports led the momentum, surging 13% to USD 2.59 billion, supported by higher prices and stronger volumes. Industrial exports recorded a 4.7% increase to USD 8.74 billion.

Within industrial exports, food, beverages and tobacco stood out with a 39.8% jump to USD 758.9 million, reflecting demand recovery and improved domestic output. Textiles and garments, Sri Lanka’s largest export category, grew 5.6% to USD 4.45 billion despite lingering global market uncertainties. However, petroleum product exports dropped 12.4%, while leather and rubber product exports fell 5.5%, signalling weak global demand in those segments.

Imports grew at an even faster pace, rising 13.8% to USD 17.55 billion in the first ten months of 2025. In rupee terms, imports increased 12.2% to Rs. 5.26 trillion. Import growth was driven by a sharp expansion in consumer goods, which surged 59.6% to USD 4.39 billion amid recovering domestic consumption and post-crisis purchasing power improvements. Investment goods imports also rose 20.5% to USD 3.37 billion, pointing to a pickup in construction and capital expenditure activity.

In contrast, intermediate goods imports, the largest component, recorded a slight decline of 0.9% to USD 9.78 billion, suggesting reduced input requirements for certain manufacturing segments.

The combined effect of higher imports relative to exports widened Sri Lanka’s trade deficit to USD 6.18 billion during January–October 2025, compared with USD 4.74 billion a year earlier. In rupee terms, the deficit stood at Rs. 1.85 trillion.

Overall, the data indicate a recovering economy with renewed domestic demand and moderate export growth, though the widening deficit underscores the continued pressure on Sri Lanka’s external sector and the need for sustained foreign exchange inflows through exports, remittances and investment.

Source: CBSL Weekly Economic Indicators