Sri Lanka’s political class loves the phrase production economy. It appears in manifestos, budget speeches, policy roadmaps, and post-crisis sermons. It is delivered with solemnity, urgency, and very little consequence. Because when rhetoric is stripped away and the economy is examined as it actually functions, the production economy Sri Lanka claims to want already exists — but only in narrow, uncomfortable pockets.

The more disturbing truth is this: Sri Lanka has not failed to produce manufacturers. It has failed to reproduce them.

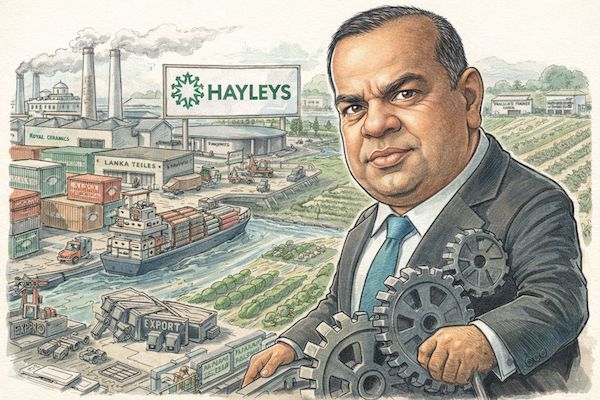

If production leadership is measured not by press conferences but by factories, exports, taxes, and jobs, then the list of serious contenders is startlingly short. At its centre sits Dhammika Perera, through corporate platforms such as Hayleys PLC and Vallibel One PLC.

This is not praise. It is diagnosis.

Follow the Assets, Not the Applause

Sri Lanka’s economy is still dominated by services, trading margins, and import-dependent consumption. Property speculation cycles faster than production lines. Trading desks multiply faster than factory floors. This is not accidental. It is the outcome of decades of policy that rewards speed, proximity, and arbitrage — not patience, capital discipline, or export survival.

Against that backdrop, production appears almost anomalous.

Hayleys and Vallibel One operate across ceramics, tiles, agro-processing, textiles, industrial chemicals, food manufacturing, logistics, energy, and finance. Crucially, their productive assets are anchored in Sri Lanka. These are not companies designed primarily to extract value offshore while retaining a domestic façade. They manufacture here, employ here, export from here, and pay taxes here.

That alone sets them apart in an economy where too many “large businesses” are structurally allergic to production risk.

When Acquisition Becomes Industrial Policy

There is a pattern that policymakers prefer not to examine too closely.

From the early 2000s onwards, industrial scale in Sri Lanka has not emerged from state-designed clusters, export credit strategies, or technology partnerships. It has emerged through acquisition. Distressed or undervalued domestic firms are bought, consolidated, retooled, and scaled — largely without the state’s strategic involvement.

Ceramics. Construction materials. Agro-exports. Non-bank finance. Cement. Food processing. Energy.

This is not how industrial policy is supposed to work. But it is how it has worked here — because governments vacated the space where industrial strategy should have lived. What filled the vacuum was corporate consolidation.

That should worry policymakers more than it does.

Exports That Don’t Need Excuses

Export data cuts through the noise.

Through Hayleys and its subsidiaries, these firms consistently rank among Sri Lanka’s largest exporters, serving markets across Asia, Europe, and North America. In several years, Hayleys alone has accounted for roughly five percent of national export earnings — an extraordinary share in an economy that endlessly complains about its lack of exporters.

Consider a detail most speeches avoid: gherkins.

Sri Lanka is one of the world’s leading exporters of preserved gherkins, with Japan as its primary destination. Local processors supply institutional food-service chains, including supply lines associated with McDonald’s Japan. This is not brand theatre. It is evidence of relentless compliance — traceability, consistency, quality control — all achieved in an economy supposedly incapable of industrial discipline.

The problem, clearly, is not capability. It is scale.

The Tax Base Nobody Wants to Name

Corporate taxation exposes another political discomfort.

Multiple independent estimates suggest that companies within this corporate ecosystem contribute close to 10 percent of Sri Lanka’s total corporate tax revenue. Official disaggregation remains opaque — a transparency failure in itself — but even cautious figures point to an outsized fiscal footprint concentrated in a narrow ownership cluster.

This collapses two popular political myths at once: that the private sector does not pay, and that production is marginal. Both cannot survive contact with the same data.

If anything, the state’s revenue dependence on a handful of producers should terrify policymakers — not reassure them.

Employment That Doesn’t Vanish Overnight

Employment figures reinforce the point.

Across Hayleys, Vallibel One, and associated entities, direct employment is estimated at 45,000–50,000 workers, excluding indirect jobs across supplier networks, logistics, and out-grower systems. These are not speculative jobs. They are factory floors, processing lines, engineers, technicians, quality controllers, and export logistics professionals.

In an economy bleeding skilled labour abroad, production employment is not just economic policy. It is demographic survival.

The Risk Politicians Won’t Admit

Yes, concentration carries risk. An economy where production capacity sits within a narrow band of corporate groups is vulnerable — to succession shocks, policy instability, and political interference.

But the greater risk lies elsewhere.

After decades of alternating governments, not one has successfully built conditions for replication. Not clusters. Not ecosystems. Not dozens of competing manufacturers. Just committees, roadmaps, and excuses.

Sri Lanka did not fail because entrepreneurs did too much. It failed because the state did far too little — and often too late.

The Real Turning Point

Sri Lanka’s production economy already exists — fragmented, under-scaled, and politically inconvenient.

It manufactures. It exports. It pays taxes. It employs people. It is domestically anchored. And it has survived despite policy, not because of it.

The real question is not why individuals like Dhammika Perera exist in Sri Lanka’s economy. The question is why, after decades of governance, the system has produced so few replicas.

That failure is not entrepreneurial.

It is political.

And until that is confronted honestly, Sri Lanka will continue to talk about production — while living off trade.

Faraz Shauketaly (www.shauketaly.com)