Risks are mounting, particularly due to the concentration of tech investment and the adverse effects of trade disruptions, which may accumulate over time. The International Monetary Fund (IMF) reports that global economic growth remains notably resilient, despite significant trade disruptions led by the United States and heightened uncertainty. According to the IMF’s latest projections, global growth is expected to remain steady at 3.3 percent this year, a 0.2 percentage point increase compared to October estimates, largely driven by improvements in the United States and China. Remarkably, these projections are largely unchanged from a year ago, as the global economy appears to be mitigating the immediate impact of tariff shocks.

This surprising strength is attributed to a combination of factors, including easing trade tensions, higher-than-anticipated fiscal stimulus, supportive financial conditions, the private sector’s agility in managing trade disruptions, and improved policy frameworks, particularly in emerging market economies.

A significant contributor to this resilience is the continued surge in investment within the information technology sector, especially in artificial intelligence. While manufacturing activity remains subdued, IT investment as a share of U.S. economic output has reached its highest level since 2001, significantly boosting overall business investment and activity. Although this IT surge is primarily concentrated in the United States, it is generating positive spillovers globally, particularly benefiting Asia’s technology exports.

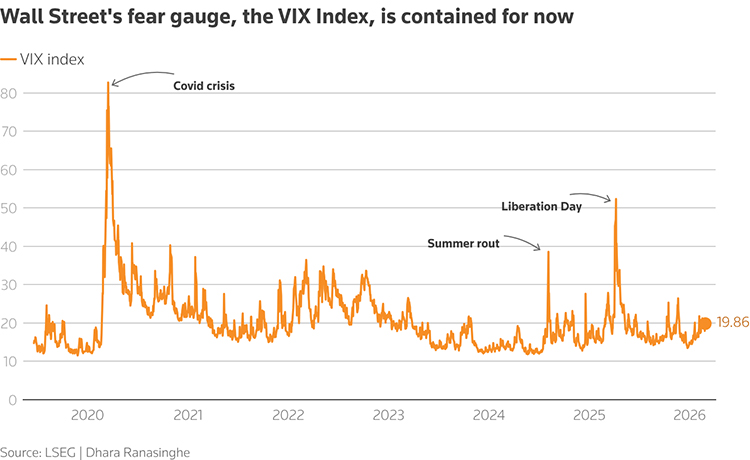

The IT investment boom reflects optimism among businesses and markets about the transformative potential of recent tech innovations, such as automation and AI, to deliver substantial productivity gains and increase profits. Since late 2022, coinciding with the introduction of the first widely used generative AI tools, stock prices have risen sharply.

Favorable financial conditions and robust earnings have supported rising stock prices and facilitated new capital expenditures. However, as expansion accelerates, debt financing is becoming more common, increasing leverage. This shift introduces notable risks: higher leverage could amplify shocks if returns fail to materialize or if broader financial conditions tighten, adversely impacting firms and raising concerns about spillovers to the broader financial system.

Additionally, profitability could become sensitive to assumptions around depreciation schedules for advanced processors. Frequent equipment upgrades could squeeze profit margins, affect earnings, and necessitate substantial additional debt financing. These factors highlight the importance of monitoring leverage accumulation and its potential to exacerbate vulnerabilities.

The comparison with the dot-com boom of 1995-2000 is instructive. While IT investment as a share of gross domestic product is similar to levels then, the recent rise has been more gradual, accelerating significantly only last year. Furthermore, while market valuations relative to economic output have expanded at a similar pace in both episodes, the rise in price-earnings ratios has been more modest in the current boom given more robust earnings.

Overall, our analysis suggests that potential overvaluation for the broad equity index in the United States is only about half that of the dot-com episode. However, the overall vulnerability of global macroeconomic growth to a repricing of technology stocks may be substantial for several reasons.

First, rising stock prices over the past few years have been driven predominantly by the technology sector, particularly AI-related stocks, making this narrow group a major driver of the index. Second, many critical AI-related firms are not currently listed on stock markets, and their debt borrowings could have consequences unseen during the dot-com era. Third, market capitalization is now much higher relative to output, from 132 percent in 2001 to 226 percent now for the United States; thus, even a more modest correction could significantly affect overall consumption.

Looking ahead, the current tech boom presents important upside and downside risks for the global economy. On the upside, AI could begin to fulfill its productivity promises, increasing U.S. and global activity by 0.3 percent this year relative to the baseline.

On the downside, AI firms could fail to deliver earnings commensurate with their high valuations, leading to souring investor sentiment. In a scenario presented in our October 2025 World Economic Outlook, which included a moderate correction in AI stock valuations with a tightening of financial conditions, global growth could reduce by 0.4 percent relative to the baseline. This could have far-reaching consequences if real investment in technology sectors declines more sharply, triggering a costly reallocation of capital and labor. Combined with lower-than-expected total factor productivity gains and a more significant correction in equity markets, global output losses could increase further, concentrated in tech-heavy regions such as the United States and Asia.

Given the decade-long increase in foreign ownership of U.S. equities, this sharp correction could also trigger sizable wealth losses outside the United States and exert a drag on consumption, spreading the downturn more globally. Even economies with little exposure to technology, including many high-debt and low-income countries, would be affected by negative external demand spillovers and higher external borrowing costs.

Such downside risks arise amid heightened geopolitical uncertainty, increased use of export controls on critical inputs, trade-related restraints, and eroded fiscal space in many countries. This could interact with any reassessment of AI-related productivity growth and repricing of risky asset valuations in a self-reinforcing manner.

With asset valuations stretched, rising debt financing, and elevated uncertainty, strong prudential oversight is essential to safeguard financial stability. Supervision and regulation should ensure robust underwriting standards by banks and non-banks, especially those exposed to the technology sector. Internationally agreed standards on bank capital and liquidity should be adhered to, and policymakers must be ready to deploy contingency plans for diverse risks.

Monetary policy faces a delicate balancing act. If the tech boom continues, it may push real neutral interest rates higher, as occurred during the dot-com era, necessitating monetary policy tightening. This would contract fiscal space, especially in countries that do not benefit from AI-driven growth.

Should the downside scenario materialize, the rapid decline in aggregate demand will call for a swift reduction in policy rates. Proper diagnosis and calibration of the monetary policy to achieve price stability require central banks to operate within their mandate. Central bank independence remains paramount for monetary and financial stability and economic growth, protecting the credibility of monetary policy and anchoring inflation expectations.

On the fiscal side, governments should renew efforts to reduce public debt and restore fiscal space where needed. AI’s uneven impact on workers is another important consideration. While innovation drives growth, it risks displacing jobs and depressing wages for certain segments of the workforce. Policies should focus on lowering barriers to adoption, helping workers to invest in the right skills, supporting job mobility through targeted programs, and maintaining competitive markets to facilitate entry and ensure that innovation benefits are broadly shared.

Global growth has been impressively resilient amid trade disruptions, but this masks underlying fragilities tied to the concentration of investment in the tech sector. The negative growth effects of trade disruptions are likely to accumulate over time. AI-driven investment offers transformative potential but also introduces financial and structural risks that demand vigilance. The challenge for policymakers and investors alike is to balance optimism with prudence, ensuring that today’s tech surge translates into sustainable, inclusive growth rather than another boom-bust cycle. This is especially relevant in an environment marked by intensifying geopolitical strains and growing threats to institutional frameworks, which make the implementation of sound policies more challenging.