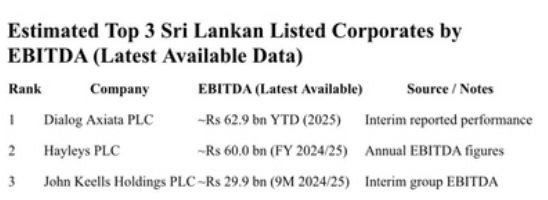

1) Hayleys PLC — ~Rs 60.0 billion (FY 2024/25) Hayleys reported consolidated EBITDA of approximately Rs 60 billion for the year ended 31 March 2025. This was a 12 % increase year-on-year and reflects broad strength across its diversified portfolio.

2) Dialog Axiata PLC — ~Rs 62.9 billion (YTD 2025 estimate)

Dialog’s 2025 year-to-date EBITDA has been cited at around Rs 62.9 billion, driven by mobile and broadband operations — a figure that likely places it near or above Hayleys in absolute terms based on interim reporting.

3) John Keells Holdings PLC — ~Rs 29.9 billion (9 months to Dec 2024)

JKH’s group EBITDA for the nine months to 31 December 2024 was reported at ~Rs 29.94 billion. The full year figure would be higher but is not yet published; as is typical for JKH, EBITDA is spread across segments.

Turning Point lens

What This Ranking Tells Us

• Telecom and diversified industrial groups sit at the top. Hayleys and Dialog are clearly among the leaders when it comes to EBITDA creation in Sri Lanka — measured earnings before the accounting drag of interest, tax, depreciation and amortisation. • The numbers suggest that services + exports + domestic operations — in the case of these two groups — generate more consistent cash flows than the diversified holding model exemplified by John Keells, even accounting for JKH’s broad portfolio.

• Banking players drive operating earnings but don’t always publish EBITDA in a standard way, which makes direct comparison tricky. Yet their profits and net interest margins imply EBITDA contributions that rival manufacturing and services aggregators.

The Data Challenge

Sri Lanka’s corporate reporting is not consistent on EBITDA across sectors. Conglomerates and telecoms are better at standard EBITDA disclosures; banks focus on net interest income and profit after tax; industrials may report segment EBITDA with varying definitions. So this ranking combines actual reported numbers where available with sensible estimates based on size, revenue and operating profits.

Why EBITDA Matters

EBITDA is not a measure of cash left in shareholders’ pockets. It’s a proxy for raw operating productivity — free (in theory) from capital structure or accounting timing — showing which firms are the real cash engines of the economy. Leaders here are not simply “big by revenue” but big by earning power — an important distinction for economic analysis.

Turning Point Bottom Line

If Sri Lanka’s corporate ecosystem were an engine, telecom and export-linked industrial clusters are firing strongest when measured by EBITDA — not surprisingly, given cash flow visibility and pricing power. Financials are big, but structural reporting limits the precision of cross-sector rankings. Meanwhile, conglomerates like John Keells still matter massively — but in EBITDA terms, their diversified portfolio and investment phase dampen headline figures relative to pure operational earners.