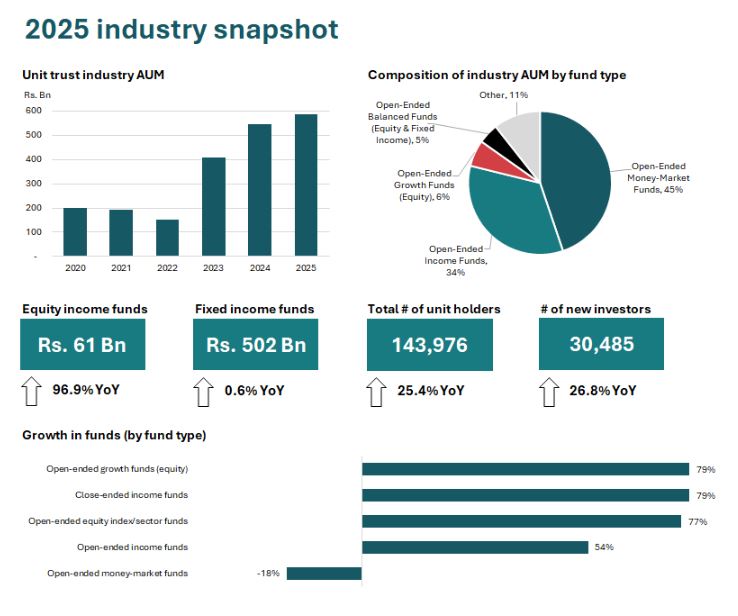

The Unit Trust industry in Sri Lanka experienced a 7.8% year-over-year increase in its assets under management (AUM), reaching Rs. 587 billion by the end of 2025. Throughout the year, the AUM peaked at Rs. 613 billion, demonstrating sustained interest in this asset category. Currently, these assets are distributed across 86 funds managed by 16 companies.

While fixed-income funds comprised the largest portion of AUM, equity-related funds experienced notable growth, with inflows increasing by Rs. 30 billion in 2025 compared to just Rs. 2 billion for fixed-income funds. This shift illustrates a change in investor sentiment from a focus on capital preservation to a strategy aimed at long-term capital growth.

The year also marked a transition from ultra-safe short-term instruments to medium-term growth investments. There was a significant influx into open-ended income funds, open-ended equity index/sector funds, and balanced funds, alongside a decrease in inflows to money-market funds. Additionally, open-ended growth funds (equity) saw a remarkable 79% year-over-year increase, indicating a growing risk appetite among investors.

In December, the number of unit holders increased by 2.0% year-over-year. The industry welcomed 30,485 new unit holders throughout the year, raising the total to 143,976, a 25.4% increase compared to the previous year.

Commenting on the industry’s performance for the year, Jeevan Sukumaran, Secretary of the Unit Trust Association of Sri Lanka (UTASL) and Director/CEO of Senfin Asset Management, stated: “Post-economic crisis, the unit trust industry has been on a strong upward trend with the AUM surpassing Rs. 600 billion last year. The steady growth of the unit trust industry in 2025 is a strong indication of increasing investor confidence in professionally managed and well-regulated investment products. Beyond the growth in fund flows, we have also seen encouraging progress in expanding the investor base — not only in terms of unit holder numbers, but also in the broadening of investor demographics — reflecting a gradual shift towards long-term, market-linked investing.”

He further added: “Looking ahead to 2026, the UTASL will continue to prioritise investor education, industry collaboration and engagement with regulators to further strengthen transparency, governance, and accessibility. We believe that these efforts will be critical in positioning unit trusts as a mainstream investment solution that supports both individual financial goals and the broader development of Sri Lanka’s capital markets.”

The UTASL serves as the representative body for the country’s licensed fund management companies, committed to maintaining the highest standards of professionalism, integrity, and transparency within the industry. Comprising 16 member companies regulated by the SEC, the UTASL aims to popularise unit trusts and encourage Sri Lankans to focus on long-term, professionally guided investing, in addition to short-term savings, contributing to national economic growth. For more information on unit trusts and to connect with management companies, visit www.utasl.lk.