The US Dollar (USD) enters the new year at a crossroads. After several years of sustained strength driven by US growth outperformance, aggressive Federal Reserve (Fed) tightening, and recurrent episodes of global risk aversion, the conditions that underpinned broad-based USD appreciation are beginning to erode, but not collapse. In my opinion, the coming year is better characterised as a transition phase rather than a clean regime shift.

- The US Dollar lost almost 10% of its value against its main peers in 2025 after years of outperformance.

- The Dollar is expected to continue to soften in 2026 as interest-rate differentials narrow and global economic growth evens out.

- Fed-related uncertainty, geopolitics, and fiscal woes could fuel volatility and bursts of Dollar strength.

2026 base case is for a moderate softening of the Greenback, led by high-beta and undervalued currencies, as interest-rate differentials narrow and global growth becomes less asymmetric.

The Fed is expected to move cautiously towards policy easing, but the bar for aggressive rate cuts remains high. Sticky services inflation, a resilient labour market, and expansionary fiscal policy argue against a rapid normalisation of US monetary settings.

In the FX galaxy, this implies selective opportunities rather than a wholesale US Dollar bear market.

Near-term risks include renewed US fiscal brinkmanship, with shutdown risk more likely to generate episodic volatility and defensive USD demand than a lasting shift in the Dollar’s trend.

Looking further ahead, the approaching end of Fed Chair Jerome Powell’s term in May introduces an additional source of uncertainty, with markets beginning to assess whether a future Fed leadership transition could eventually tilt policy in a more dovish direction.

Overall, the year ahead is less about calling the end of Dollar dominance and more about navigating a world in which the USD is less irresistible but still indispensable.

US Dollar in 2025: From exceptionalism to exhaustion?

The past year was not defined by a single shock but by a steady sequence of moments that kept testing, and ultimately reaffirming, the US Dollar’s resilience.

It began with a confident consensus that US growth would slow and that the Fed would soon pivot towards easier policy. That call proved premature, as the US economy remained stubbornly resilient: activity held up, inflation cooled only slowly, and the labour market stayed tight enough to keep the Fed cautious.

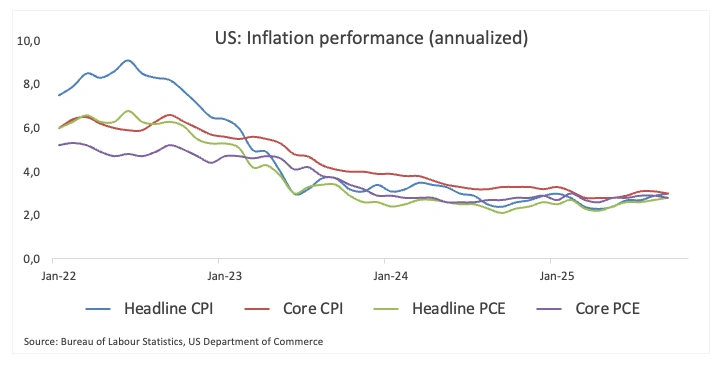

Inflation became the second recurring fault line. Headline pressures eased, but progress was uneven, particularly in services. Every upside surprise reopened the debate about how restrictive policy really needed to be, and each time the result looked familiar: a firmer Dollar and a reminder that the disinflation process was not yet complete.

Geopolitics added a constant background hum. Tensions in the Middle East, the war in Ukraine, and fragile US-China relations – namely on the trade front – regularly unsettled markets.

Outside the US, there was little to challenge that setup: Europe struggled to generate clear momentum, China’s recovery failed to convince, and relative growth underperformance elsewhere capped the scope for sustained Dollar weakness.

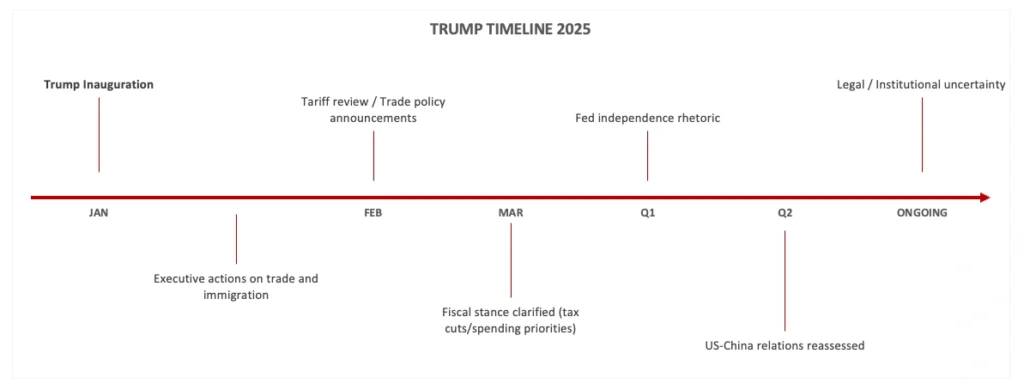

And then there’s the Trump factor: Politics has mattered less as a clean directional driver for the Dollar and more as a source of recurring volatility. As the timeline below shows, periods of heightened policy or geopolitical uncertainty have typically been moments when the currency benefited from its safe-haven role.

Fed, Trump and geopolitics to shape US Dollar valuation in 2026

Moving into 2026, that pattern is unlikely to change. The Trump presidency is more likely to influence FX through bursts of uncertainty around trade, fiscal policy, or institutions than through a predictable policy path.

Federal Reserve Policy: Cautious easing, not a pivot

The Fed policy remains the single most important anchor for the US Dollar outlook. Markets are increasingly confident that the peak in the policy rate is behind us, but expectations for the pace and depth of easing remain fluid and, in my view, somewhat over-optimistic.

Inflation has clearly moderated, but the final leg of disinflation is proving stubborn, with both headline and core Consumer Price Index (CPI) growth still above the bank’s 2.0% goal. Services inflation remains elevated, wage growth is only slowly cooling, and financial conditions have eased materially. The labour market, while no longer overheating, remains resilient by historical standards.

Against this backdrop, the Fed is likely to cut rates gradually and conditionally, rather than embark on an aggressive easing cycle.

From an FX perspective, this matters because rate differentials are unlikely to compress as rapidly as markets currently expect.

The implication is that USD weakness driven by Fed easing is likely to be orderly rather than explosive.

Fiscal dynamics and the political cycle

US fiscal policy remains a familiar complication for the Dollar outlook. Large deficits, rising debt issuance, and a deeply polarised political environment are no longer temporary features of the cycle; they are part of the landscape.

There is a clear tension at work: On the one hand, expansive fiscal policy continues to support growth, delays any meaningful slowdown, and indirectly props up the Dollar by reinforcing US outperformance. On the other, the steady increase in Treasury issuance raises obvious questions about debt sustainability and how long global investors will remain willing to absorb an ever-growing supply.

Markets have been remarkably relaxed about the so-called “twin deficits” thus far. Demand for US assets remains strong, drawn by liquidity, yield, and the absence of credible alternatives at scale.

Politics adds another layer of uncertainty. Election years – there will be midterms in November 2026 – tend to lift risk premia and inject short-term volatility into FX markets.

The recent government shutdown serves as a prime example: despite the US government resuming operations after 43 days, the main issue remains unresolved. Lawmakers have pushed the next funding deadline to January 30, keeping the risk of another standoff firmly on the radar.

Valuation and positioning: Crowded, but not broken

From a valuation standpoint, the US Dollar is no longer cheap, but neither does it screen as wildly stretched. Valuation alone, however, has rarely been a reliable trigger for major turning points in the Dollar cycle.

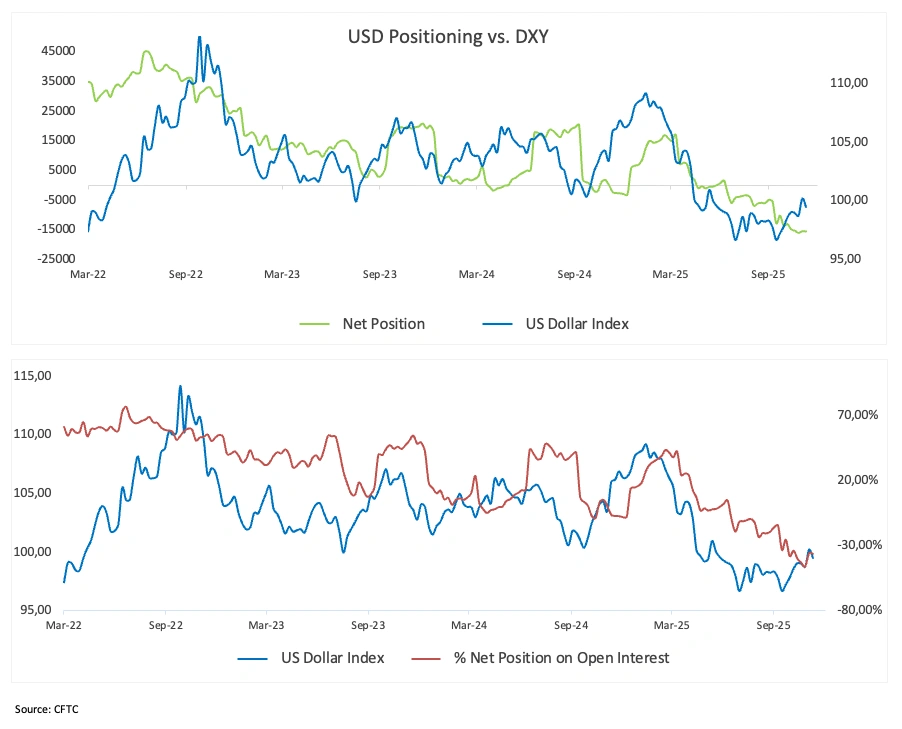

Positioning tells a more intriguing story: Speculative positioning has swung decisively, with USD net shorts now sitting at multi-year highs. In other words, a meaningful portion of the market has already positioned for further Dollar weakness. That does not invalidate the bearish case, but it does change the risk profile. With positioning increasingly one-sided, the hurdle for sustained USD downside rises, while the risk of short-covering rallies grows.

This matters particularly in an environment still prone to policy surprises and geopolitical stress.

Put together, a relatively rich valuation and heavy short positioning argue less for a clean Dollar bear market and more for a choppier ride, with periods of weakness regularly interrupted by sharp and sometimes uncomfortable counter-trend moves.

Geopolitics and safe-haven dynamics

Geopolitics remains one of the quieter, but more reliable, sources of support for the US Dollar.

Rather than one dominant geopolitical shock, markets are dealing with a steady build-up of tail risks: Tensions in the Middle East remain unresolved, the war in Ukraine continues to weigh on Europe, and US-China relations are fragile at best. Add in disruptions to global trade routes and a renewed focus on strategic competition, and the background level of uncertainty stays elevated.

None of this means the Dollar should be permanently bid. But taken together, these risks reinforce a familiar pattern: when uncertainty rises and liquidity is suddenly in demand, the USD continues to benefit disproportionately from safe-haven flows.

Outlook for the major currency pairs

- EUR/USD: The Euro (EUR) should find some support as cyclical conditions improve and energy-related fears fade. That said, Europe’s deeper structural challenges haven’t gone away. Weak trend growth, limited fiscal flexibility, and an European Central Bank (ECB) that is likely to ease earlier than the Fed all cap the upside.

- USD/JPY: Japan’s gradual move away from ultra-loose policy should help the Japanese Yen (JPY) at the margin, but the yield gap with the US remains wide, and the risk of official intervention is never far away. Expect plenty of volatility, two-way risk, and sharp tactical moves, rather than anything that resembles a smooth, sustained trend.

- GBP/USD: The Pound Sterling (GBP) continues to face a tough backdrop. Trend growth is weak, fiscal headroom is limited, and politics remains a source of uncertainty. Valuation helps at the margin, but the UK still lacks a clear cyclical tailwind.

- USD/CNY: China’s policy stance remains firmly focused on stability, not reflation. Depreciation pressures on the Renminbi (CNY) haven’t disappeared, but authorities are unlikely to tolerate sharp or disorderly moves. That approach limits the risk of broader USD strength spilling over through Asia, but it also caps the upside for emerging-market FX tied closely to China’s cycle.

- Commodity FX: The likes of the Australian Dollar (AUD), Canadian Dollar (CAD), and Norwegian Krone (NOK) should benefit when risk sentiment improves and commodity prices stabilise. Even so, any gains are likely to be uneven and highly sensitive to Chinese data.

Scenarios and risks for 2026

In my base case (60% probability), the Dollar gradually loses some ground as interest-rate differentials narrow and global growth becomes less uneven. This is a world of steady adjustment rather than a sharp reversal.

A more bullish outcome for the USD, (around 25%), would be driven by familiar forces: inflation proving stickier than expected, Fed rate cuts being pushed further out (or no cuts at all), or a geopolitical shock that revives demand for safety and liquidity.

The bearish Dollar scenario carries a lower probability, around 15%. It would require a cleaner global growth recovery and a more decisive Fed easing cycle, enough to materially erode the buck’s yield advantage.

Another source of uncertainty sits around the Fed itself. With Chief Powell’s term ending in May, markets are likely to start focusing on who comes next well before any actual change takes place. A perception that a successor might lean more dovish could gradually weigh on the Dollar by eroding confidence in US real yield support. As with much of the current outlook, the impact is likely to be uneven and time-dependent rather than a clean directional shift.

Taken together, the risks remain tilted towards episodic bouts of Dollar strength, even if the broader direction of travel points modestly lower over time.

US Dollar Technical Analysis: DXY seen mostly sidelined in 2026

From a technical standpoint, the Dollar’s recent pullback still looks more like a pause within a broader range than the start of a decisive trend reversal, at least when viewed through the lens of the US Dollar Index. Step back to the weekly and monthly charts, and the picture becomes clearer: the DXY remains comfortably above its pre-pandemic levels, with buyers continuing to show up whenever stress creeps back into the system.

On the downside, the first real area to watch sits around the 96.30 region, roughly three-year lows. A clean break below that zone would be meaningful, bringing the long-term 200-month moving average just above 92.00 back into play. Below there, the sub-90.00 area, last tested around the 2021 lows, would mark the next major line in the sand.

On the topside, the 100-week moving average near 103.40 stands out as the first serious hurdle. A move through that level would reopen the door towards the 110.00 area, last reached in early January 2025. Once (and if) the latter is cleared, the post-pandemic peak near 114.80 from late 2022 could start shaping up on the horizon.

Taken together, the technical picture fits neatly with the broader macro story. There is room for further downside, but it is unlikely to be smooth or uncontested. Indeed, the technicals point to a DXY that remains range-bound, paying attention to shifts in sentiment, and prone to sharp counter-moves rather than a clean, one-directional decline.

Conclusion: The end of the peak, not the privilege

The year ahead is unlikely to mark the end of the US Dollar’s central role in the global financial system. Instead, it represents the end of a particularly favourable phase in which growth, policy, and geopolitics aligned perfectly in its favour.

As these forces slowly rebalance, the Greenback should lose some altitude, but not its relevance. For investors and policymakers alike, the challenge will be to distinguish between cyclical pullbacks and structural turning points. In my view, the former is far more likely than the latter.