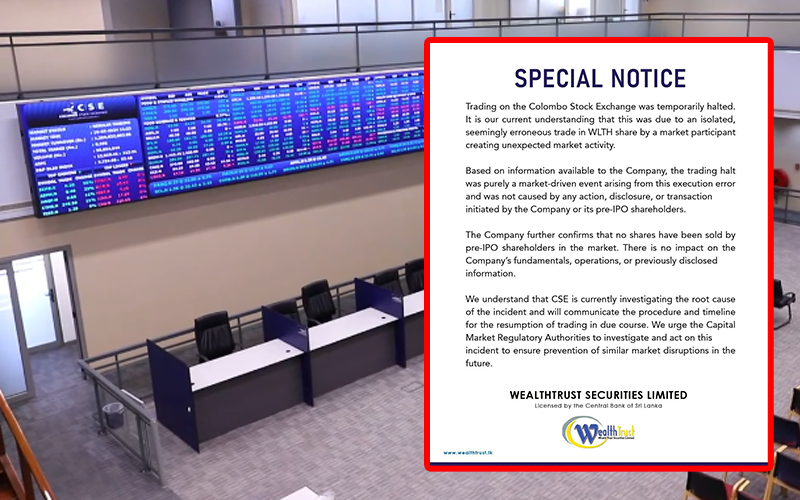

WealthTrust Securities Limited (WLTH.N0000) has issued a statement clarifying that the temporary market-wide trading halt on the Colombo Stock Exchange (CSE) today, the 7th, was triggered solely by an isolated erroneous trade executed by a market participant. The company emphasized that neither it nor its pre-IPO shareholders were involved in the incident.

The licensed Primary Dealer, which debuted on the CSE’s Diri Savi Board today following a successful Rs. 500 million IPO in December 2025, highlighted that the incident was “purely a market-driven event arising from this execution error.”

In its special notice, the company stated: “The trading halt was not caused by any action, disclosure, or transaction initiated by the Company or its pre-IPO shareholders.” It further confirmed that no shares have been sold by pre-IPO shareholders in the market and assured that there is no impact on the company’s fundamentals, operations, or previously disclosed information.

Reports indicate that unusual prices were observed early in trading, including an apparent trade at extraordinarily high levels, prompting the CSE to intervene. The exchange has announced it will cancel all pre-halt transactions and purge outstanding orders to ensure a fair resumption.

WealthTrust Securities supports the ongoing CSE investigation and has urged capital market regulators to thoroughly probe the matter to prevent future disruptions.

The company reassured investors that its business remains strong and unaffected, with operations continuing normally. Trading is expected to resume once the CSE completes its procedures.