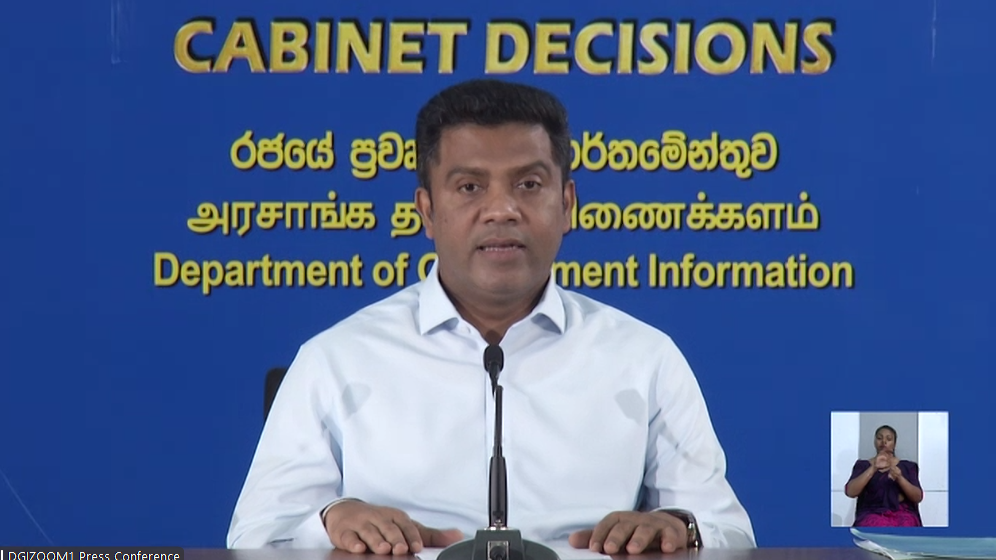

A delegation from Sri Lanka, led by Deputy Minister of Industry and Entrepreneurship Development Chathuranga Abeyasinghe, engaged in a fruitful discussion with senior officials of the Saudi Public Investment Fund (PIF) at their headquarters in Riyadh on January 25, 2026.

During the meeting, Minister Abeyasinghe delivered a comprehensive presentation that underscored Sri Lanka’s competitive advantages and investment prospects. The dialogue also served as a platform to highlight the potential of Sri Lanka’s capital market. Chairman of the Securities and Exchange Commission of Sri Lanka, D.B.P.H. Dissabandara, and Chief Executive Officer of the Colombo Stock Exchange, Rajeeva Bandaranaike, informed the PIF officials about Sri Lanka’s new policies and regulatory reforms designed to bolster investor confidence and promote sustainable market growth.

PIF Senior Director, Mulham Albakree, outlined the Fund’s Strategic Plan for 2026–2030, focusing on principal areas of international investment interest. He also stressed the significance of establishing a Bilateral Investment Protection Agreement between Sri Lanka and Saudi Arabia. Both parties concurred on maintaining an open communication channel to follow up on matters discussed during the meeting.

The Ambassador of Sri Lanka to the Kingdom of Saudi Arabia, Ameer Ajwad, provided an update on existing bilateral agreements, including the Agreement on the Avoidance of Double Taxation between the two nations.

Other notable attendees included Director of the Colombo Stock Exchange, M. Ray Abeywardena; Officer-in-Charge / Deputy Director General of the Securities and Exchange Commission of Sri Lanka, Tushara Jayaratne; Senior Vice President – Marketing of the Colombo Stock Exchange, Niroshan Wijesundere; and First Secretary of the Embassy of Sri Lanka, Tashma Vithanawasam.

The Public Investment Fund (PIF) is the sovereign wealth fund of the Kingdom of Saudi Arabia and ranks among the largest and most influential sovereign wealth funds worldwide. PIF is pivotal in advancing Saudi Arabia’s Vision 2030 by driving economic diversification, fostering innovation, and supporting sustainable long-term growth. The Fund manages a globally diversified investment portfolio across strategic sectors such as energy, mining, infrastructure, logistics, manufacturing, tourism, real estate, technology, healthcare, financial services, and capital markets.