FINANCIAL CHRONICLE – Sri Lanka is currently navigating a precarious period of economic growth, facing challenges in maintaining monetary stability due to high inflation targets and currency depreciation. The recent devaluation of the rupee in 2025, despite a record current account surplus, highlights significant flaws in the central bank’s operational framework, which can lead to increased prices, public dissatisfaction, and political unrest.

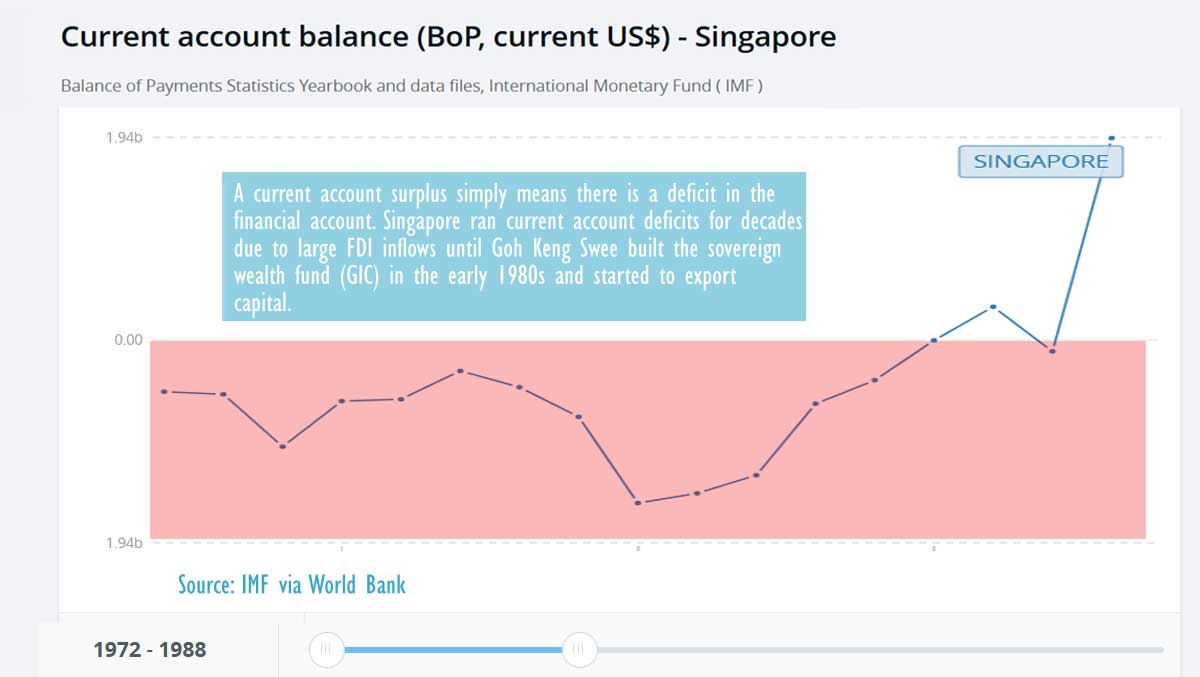

The current account surplus indicates that Sri Lanka is repaying debt or building reserves, resulting in a financial account deficit. In a scenario where the country attracts substantial foreign direct investments and the government engages in deficit financing, or there are net inflows into the stock market, Sri Lanka would experience current account deficits as capital inflows are utilized domestically. For instance, Singapore experienced persistent current account deficits during its high-growth years, only turning to surpluses after the establishment of the Government Investment Corporation (GIC) in 1981 and subsequent investment of provident fund money abroad.

This understanding seems to be absent among economists who reject classical economic principles, which became prevalent in English-speaking universities post-Great Depression. Singapore and other East Asian nations, by allowing large capital outflows and maintaining deflationary or neutral monetary policies, managed to avoid the pitfalls of excessive inflation and currency depreciation that have plagued Sri Lanka.

Sri Lanka’s central bank deserves recognition for halting inflationary open market operations, enabling debt repayment and facilitating financial outflows. However, the recent depreciation of the rupee due to excessive dollar purchases reveals a critical flaw in the central bank’s framework, potentially threatening the current administration’s stability, as seen in IMF-backed frameworks affecting many post-independence governments.

Central banks are not inherently equipped to build reserves. When they purchase dollars, they create new rupees, which, as noted by founding Governor John Exter, is ‘actively inflationary.’ To maintain monetary stability, the created money must be quickly extinguished through treasury sell-downs or terminating buy-sell swaps. Failure to do so leads to rupee depreciation when these new rupees are converted into imports.

President Anura Kumara Dissanayake has emphasized the need for exchange rate stability, akin to Singapore’s approach, but this call has been largely ignored. COPF member Harsha de Silva made a similar appeal in 2018, advocating for interbank rates to rise to protect the exchange rate and reserves, yet it was dismissed due to the ‘central bank independence’ policy in effect.

The Yahapalana administration suffered at the polls due to inflation and stabilization crises linked to central bank policies. Many families in Sri Lanka are now struggling financially, with inflation targeting and currency devaluation exacerbating their hardships. The government is compelled to raise fuel and electricity prices despite relatively stable US Fed policies, leading to political challenges.

The ongoing depreciation, despite current account surpluses, underscores the dangers of dismissing classical economics in favor of newer economic doctrines. Sri Lanka’s reliance on central bank reserves and lack of dollar tax revenues perpetuates a debt trap, misinterpreted by the IMF as an ‘external financing gap.’

Historically, rate cuts aimed at stimulating growth have led to economic instability, as seen in multiple currency crises since 2011. Treasury officials have disclosed that loan repayments are precariously managed, and a more stable approach, involving dollar reserves and taxes, could mitigate borrowing needs.

Economic stability is paramount, as without it, growth prospects are undermined. Sri Lanka’s recent struggles stem from misguided attempts to boost growth through monetary policy, which often results in failed IMF programs and social unrest. The emphasis on monetary stability, as advocated by classical economists, remains crucial for sustainable growth.

Throughout history, Sri Lanka has faced challenges due to central bank policies leading to inflation and currency devaluation. The current administration, like its predecessors, risks destabilization unless it prioritizes monetary stability over short-term growth incentives.

Ultimately, it is the responsibility of the parliament to ensure the central bank adheres to a stable monetary policy. Failure to do so has historically resulted in economic turmoil and political upheaval, a lesson that remains relevant for Sri Lanka’s future economic governance. (Colombo/Jan13/2026)